There are benefits to acquiring this tangible commodity. Knowing both the potential pitfalls and benefits can balance the scales of any potential risks.

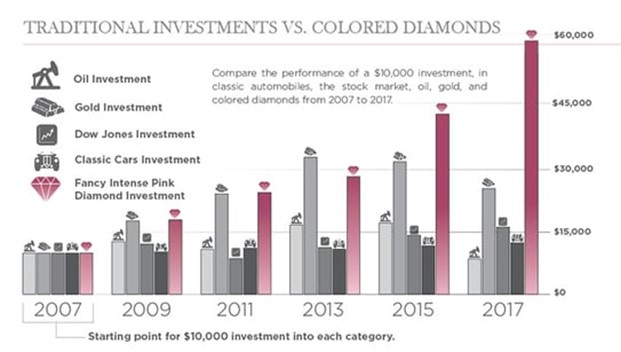

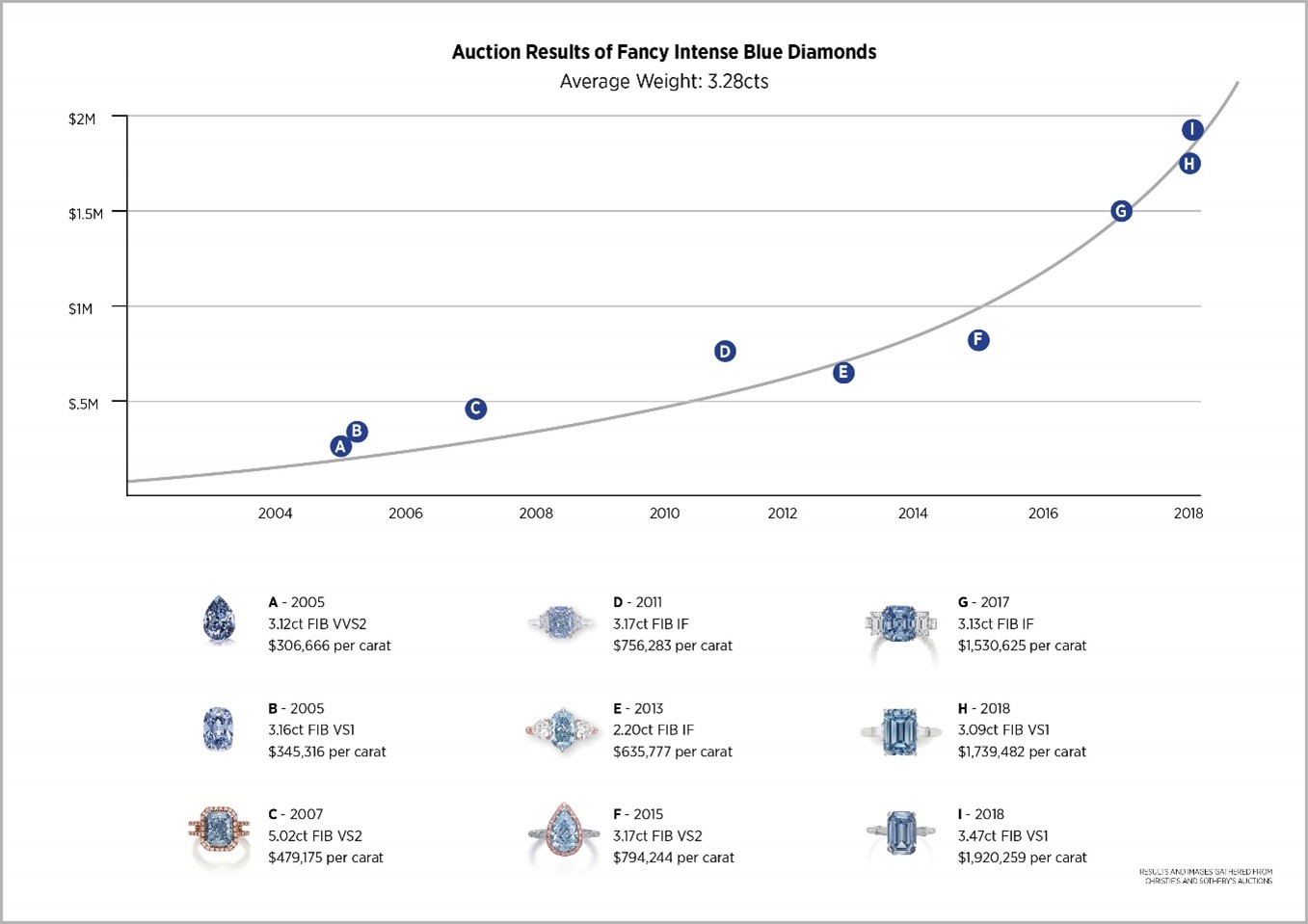

Since 2008 the global economy has gone through many ups and downs. The financial crisis of 2008 showed everyone how volatile even the most tangible, long term investments such as real estate can be. Multitudes of people lost everything and had to walk away from their life savings – primarily in the form of equity in their homes. It is during these difficult times that people start to look for alternative, tangible, long term investments. It is also during these times that people appreciate the advantages of physical, portable commodities. Therefore, currency debasement around the world has led to people seeking hard assets – assets which cannot be created by a printing press or the tap of a keyboard; and it is well known that both literally and figuratively, there are not many assets harder than diamonds.

While we do not recommend purely buying diamonds or gemstones either loose or already mounted as jewelry solely for a potential upside, if you do, they should absolutely fall into your category of alternative investments. This means that they should be a very small portion of a diversified portfolio, and not more than you are financially willing to lose. As with any investment, “Diversification is protection against ignorance”, Warren Buffett. However, there are other reasons to acquire diamonds and gemstones, and not the least of which, is the pleasure it brings the wearer and or owner.

Before we dive into the positive and potential negatives of acquiring diamonds and fine gemstones, let’s start with the basics.

Learn the basics about diamonds and gemstones. Regarding diamonds, start with the 4 Cs of Diamonds. Learn how these 4 characteristics affect the value and resale value of a diamond or gemstone. There is much diversity and speculation when investing in diamonds and rare gemstones. Knowing what you are buying requires education and or engaging a trusted professional.

Compare Prices. This takes a little effort since a diamond or fine gemstone’s price is not set by thousands of buyers and sellers bidding online in a transparent platform, as is the case with the stock market. However, with the advent of the internet and online retailers you can easily compare asking prices for similar diamonds. This is more difficult when it comes to colored diamonds and fine gemstones, because of rarity, and the fact that there are less product in the market to compare similarities.

Buy only certified diamonds and gemstones. We recommend only buying diamonds or gemstones certified specifically by the Gemological Institute of America (GIA). With all the synthetic, lab created, and artificial diamonds and gemstones on the market, there is a high risk of fraud without a GIA certificate to verify what you are buying. You can always verify that an accompanying GIA certificate is genuine by scanning the QR code or entering the certificate number into the GIA website. This will also ensure an easier sale when/if you decide to liquidate your diamond or gemstone.

Engage a Professional that you can Trust. It is important to engage a diamond and or gemstone expert. You should establish a relationship with a sophisticated diamond and or gemstone advisor knowledgeable in the nuances of diamond and gemstone quality as well as international diamond and gemstone pricing and markets. Your advisor should also have direct buy/sell trading access to the global diamond and or gemstone markets to ensure fair market value bid/ask pricing. Significant Stones can be that professional.